Green tax reform, endogenous innovation and the growth dividend

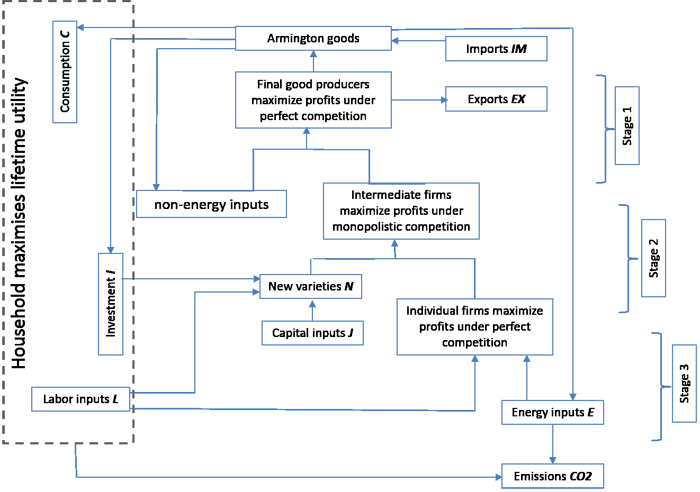

Dr. Lin Zhang presented his studies on the effects of an environmental tax reform using endogenous growth theory. The growth dividend can be observed even with low labour-energy elasticity of substitution and pre-existing tax distortions. Redistribution of additional carbon tax revenue by lowering capital taxation performs best in terms of efficiency measured by aggregate welfare. In terms of equity among social segments, the progressive character of lump-sum redistribution fails when very high emissions reduction targets are considered.