Main navigation

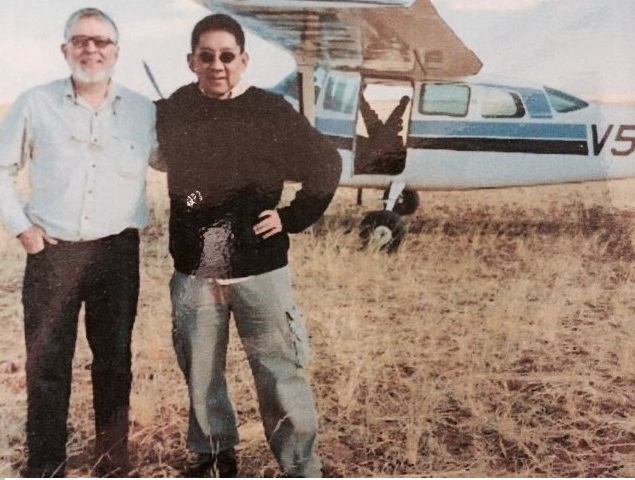

“Yes, everywhere I go, there have been many riveting experiences and hair-raising adventures,” thus spake Mark Siu, casually. A veteran venture capitalist (VC) in the TMT (technology, media and telecom) domain, Mark has been strategic officer of numerous M&A (mergers and acquisitions) deals covering much of Africa, North America and Asia. He has also been adjunct professor at CityU, as well as an Entrepreneur-in-Residence of the university’s Knowledge Transfer Office, offering valuable advice and guidance to our start-up teams. Presently, Mark is Chief Strategist of Transmedia Communications Limited, a Hong Kong-based company dedicated to provide TMT consultancy service in Greater China and all over the world.

Gamblelike VC

Nowadays, we often come across the term ‘venture capitalist’. What exactly is that? According to Investopedia, the world's leading source of financial content on the web, a venture capitalist is “a private equity investor that provides capital to companies with high growth potential in exchange for an equity stake. This could be funding startup ventures or supporting small companies that wish to expand but do not have access to equities markets.”

To paraphrase George Orwell’s famous words in his Animal Farm: “All investments are risky, but some investments are more risky than others.” As such, VC investments are undoubtedly dicier and more gamblelike than other types of ‘safe’ investment. Speaking of gambling, it is worth noting that Mark was once senior executive of TVB covering production and as creative director, and he was a screenwriter of The Shell Game, a well-received soap opera about gambling that starred Patrick Tse as the king gambler and Liza Wang as his wife. Isn’t VC investment quite like gambling? “Indeed!” replied Mark.

Three commandments

That said, being a VC requires much more than sheer luck. Mark shared several ‘commandments’ that one needs to adhere to.

First Commandment: “Thou shalt not be egocentric.” Mark advised gently yet firmly: “While managing our bosses, we have to have a very tiny ego. We must humble ourselves.” What he means is that VCs should not allow their personal preferences to influence business decisions. “Everything should be market-driven. We have to be responsible for the fund.”

Second Commandment: “Thou shalt not be ethnocentric.” Therefore, VCs should not apply their own ethnicity or culture as a frame of reference to judge the beliefs and behaviours of other races or cultures. “Ethnocentrism is even more detrimental than egocentrism,” Mark warned explicitly.

Respect & understanding

Having travelled to dozens of countries across the globe to negotiate and seal business deals, Mark has had more than enough experiences about the peculiar practices in different cultures. Take Indonesia, the most populous Muslim-majority country, as an example. “Sometimes, all the employees would suddenly disappear while attending a meeting. The reason? It was time for the Muslims to offer up their Salah, or prayer, to Allah.”

There were other interesting practices in the world’s largest island country. In one village, a man may have four wives, “because Muslims are allowed to do so.” Then in another village nearby, a woman may have four husbands, “because theirs was still a matrilineal society as practised since the Stone Age, in which kinship is traced through the mother line.” Inevitable conclusion and healthy attitude? “We have to respect and try to understand different cultures.”

Crafty Hong Kongers

After encountering so many different peoples and cultures, Mark has the following honest and constructive observation: “Hong Kong people are the most crafty. They are too clever, and they are also too short-sighted.” Also, our comfort zone is too large, “which makes it hard for us to come up with innovative ideas.”

Third commandment: “Thou shalt not be a control freak.” Mark said in an unassuming manner: “I sincerely believe that everybody is better than I in some aspects.” Only in this way can a VC listen attentively and sympathetically to what the people in the potential companies want to say.

Passion, passion

Just as a person needs to possess certain desirable traits to be a competent VC, on the other side of the deal, an entrepreneur and his or her company must also exhibit certain admirable qualities to deserve investment from a VC. So, what criteria does Mark adopt when he decides whether to invest in a startup or not?

“Passion,” Mark mentioned this key word several times. “The person needs to be immensely enthusiastic about what he or she is doing.” He cited Facebook co-founder Mark Zuckerberg as an example. “He may have earned a lot of money as a spinoff, but what’s of fundamental importance is that he’s intensely interested in what he’s doing. He has a fiery passion for changing the world.” Such a trailblazer believes fervently in his own great dream.

Endurance & dedication

The second criterion is integrally related to the first one, which is the willingness to endure hardships. “Zuckerberg and the like would just have meetings, with their notebook computers in hand, sitting and sleeping on the floor night and day.” Mark himself has had similar experiences in the Chinese mainland. “We would hold meetings just beside the men’s toilet. The foul odour was so overpowering that we could barely tolerate it!” Yet, many brilliant ideas have emerged in such appalling conditions.

The third criterion is also intimately linked to the first two. “Dedication,” Mark said. Which is the willingness to devote a lot of time and energy to achieve the burning ambitions. He mentioned luck again. “You just cannot bank on luck.”

Of course, there are yet other rather obvious yet equally important criteria. For example, people need to be knowledgable in their own field, and they must have vision.

Is there anything that would prompt Mark to reject a proposal right away? He immediately gave a simple and straightforward answer: “Lack of any USP (unique selling proposition).”

Exceptional but normal

If making investment and visiting different countries are outward adventures, then an inward adventure for Mark is probably a film about autism that he directed.

Without any mawkish sentimentality, The Normal Exceptional is a documentary depicting, in a realist spirit, the daily lives of highly functional autistic students, as well as their interactions with parents and teachers. Seven years in the making with participation of plenty of colleagues and students from School of Creative Media from CityU, the movie has been shown in cinemas all over Hong Kong since March 2021. After each screening, teachers and psychologists would hold a seminar to explore the issue of autism and SEN students (ie, students with special educational needs) with the audience. “We want to let the public know that ‘weird’ people can also be very OK.”

Philanthropy

In a meaningful sense, the aim of the documentary resonates with the commandments of being a VC: we have to be sympathetic to people who are different from us, and we can build an inclusive and compassionate society together.

Why did Mark decide to shoot such a film? “It’s a form of philanthropy,” Mark explained. “I firmly believe that we should contribute to society.”

Is there any likeness between being a VC and making a heart-melting, tear-jerking documentary? “Not at all!” Mark said jokingly. “On the contrary, one is earning money and the other is spending money!”

Dreaming & awakening

Mark’s wonderful adventures, both without and within, remind us of the wise words that the renowned Swiss psychiatrist and psychoanalyst Carl Jung once wrote to one of his clients: “Who looks outside dreams; who looks inside awakes.” One the one hand, by reaching out, Mark pursues his own dreams while helping others fulfil theirs; On the other hand, he helps people awake to the possibility of a better world by encouraging us to look inside our own and others’ authentic self. We see in Mark a shining archetype of the investor-cum-philanthropist.