Latest News & Upcoming Events

- -Professor Yavar Kian

- -Professor Francois Delarue

We have strong mission to provide high quality education in mathematics and conduct first-class research in applied mathematics. We are striving for excellence in both teaching and research in applied mathematical sciences.

PUBLICATIONS

Research

Research is a major function of the Department, and a considerable amount of emphasis has been placed on this area.

Learn MoreOUR PROFESSORS

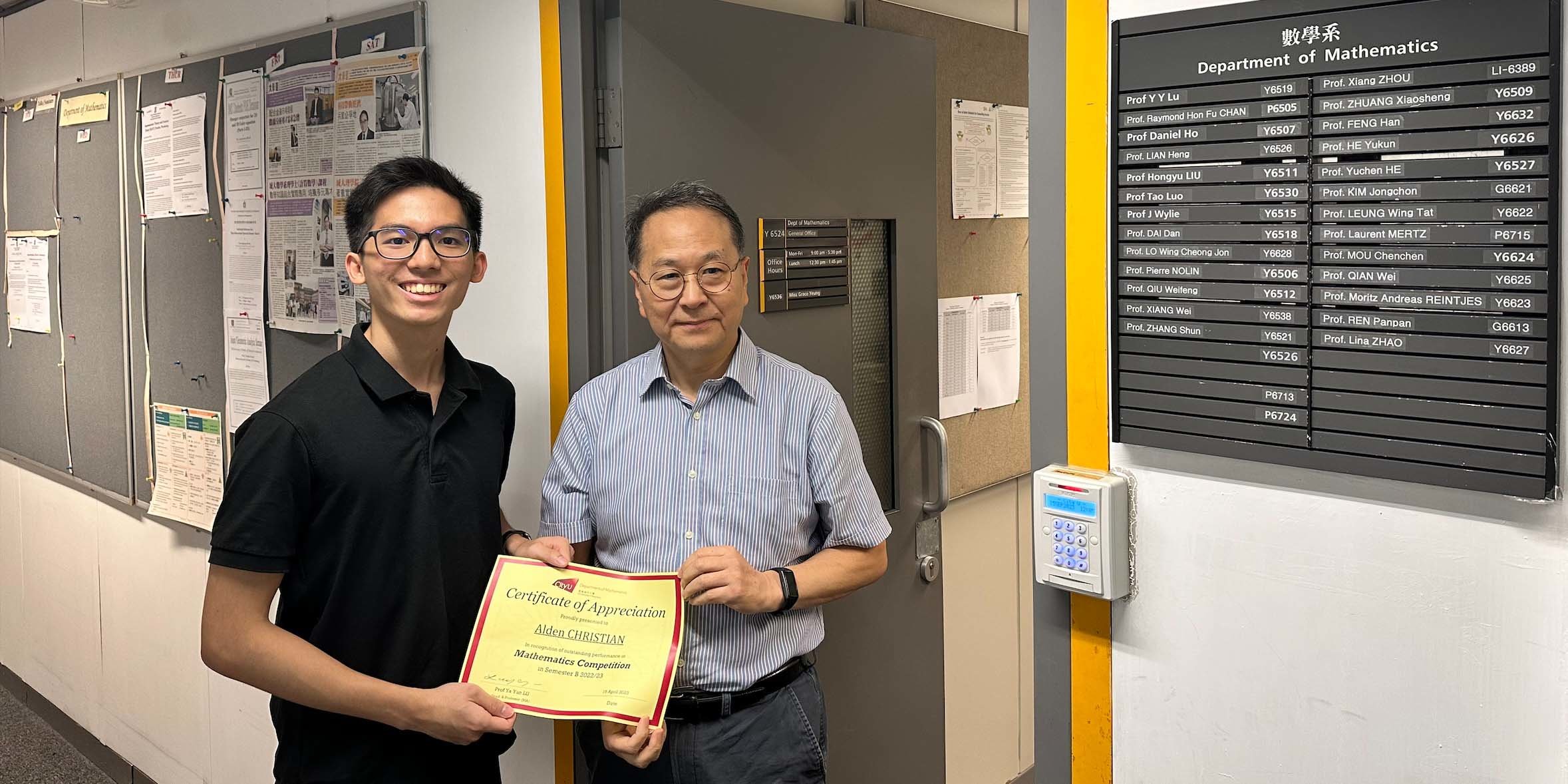

Faculty Members & Visiting Staff

Learn more about our Honorary Professor, Emeritus Professor, Faculty Members, and Visiting Staff.

Learn More